18 Jul 2017

Mark Stevens discusses a widely heralded scheme, including how it will operate and how it will affect businesses.

Following the 2015 general election, the newly elected government revealed ambitious targets to significantly increase the number of apprenticeships in the UK. The plan was these apprenticeships would be funded, in large part, by employers and, in turn, they would be able to access the benefits of the new system.

The Government then put forward more detailed proposals for a new levy on large employers, with the aim of supporting three million new apprenticeships for people above the age of 16 by 2020. In essence, the levy is an obligation on all qualifying UK employers in both the public and private sectors to fund new apprenticeships from May 2017.

The Government then put forward more detailed proposals for a new levy on large employers, with the aim of supporting three million new apprenticeships for people above the age of 16 by 2020. In essence, the levy is an obligation on all qualifying UK employers in both the public and private sectors to fund new apprenticeships from May 2017.

Although skills training is a devolved policy issue in the UK, the levy will apply equally to employers in England, Northern Ireland, Wales and Scotland. The government has plans to work with the devolved administrations to understand how they intend the levy to operate in their particular areas, but it appears they plan to use the additional funds as a supplement to existing funding arrangements, rather than operate any centralised digital system comparable to that being set up in England.

The purpose of the levy is to encourage employers to invest in apprenticeship programmes and raise additional funds to improve the quality and quantity of apprenticeships. The levy paid by employers can then be accessed by those same employers to fund apprenticeship training in their business.

In England, control of apprenticeship funding will be put into the hands of employers through the Digital Apprenticeship Service (DAS) – an online service that allows employers to:

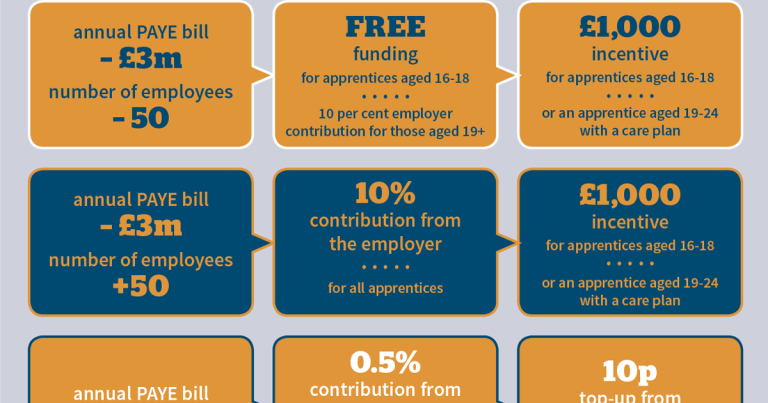

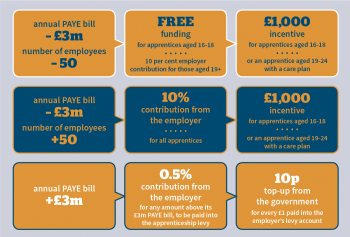

The levy will be charged at a rate of 0.5% of an employer’s pay bill and only be paid on annual pay bills in excess of £3 million. In reality, this affects fewer than 2% of UK employers. The levy will be collected by HMRC through PAYE, alongside income tax and national insurance contributions.

The pay bill will be calculated with reference to total employee earnings (not additional payments, such as benefits in kind) and will be payable by the employer on a monthly basis. It will be up to employers to notify HMRC each month as to whether they are eligible to pay the levy.

When the money goes into the DAS, it gains a 10% top-up from the government. This means for every £1 that enters a business’ digital account, it gets an additional 10p. For example, if a company has a payroll of £3 million, it will pay £15,000 in levy payments throughout the year, which will gradually appear in its digital apprenticeship account, and it will gain an additional £1,500 (or 10% from the government for the same period. Therefore, the company will have £16,500 in its digital account to pay for apprenticeship training and assessment.

A further aspect of the levy proposals will see each employer receive an annual allowance of £15,000 to offset against its levy payment. If the employer has more than one payroll reference (say, different businesses), it may apportion the allowance between them.

The levy allowance is spread evenly throughout the year, so the amount offset against each monthly levy liability is one-twelfth of the total allowance for the year the employer is entitled to.

Any unused allowance from one month is carried forward to offset against subsequent months. At the end of the tax year, the employer may reallocate any unused portion of the levy allowance for one payroll against the liability for another. If the levy has been overpaid, the employer must offset the overpayment against its other PAYE liabilities, before making a claim to HMRC for reimbursement of any remaining excess.

Where an employer starts or stops trading during a tax year, the prorated share of its allowance for the earlier or later months (as appropriate) is added to that of the month of commencement or cessation (so the full annual allowance still applies).

If an employer chooses to adjust a previous month’s pay bill, it should account for the change in its next employer payment summary (EPS). If, at the end of the year, it determines the national insurance contributions reported to HMRC are incorrect, it must submit a correcting EPS.

Where the allowance relates to a group of employers (for example, different offshoots of a practice), only one annual allowance of £15,000 will be available and it will be for the employers themselves to determine how this is apportioned between them.

Each apprenticeship framework will have a maximum funding band and the government has set 15 different bands. Employers can then negotiate an appropriate price with their training provider – many larger businesses with a training department may be able to make the levy go further by offsetting some of their own training facilities.

Those that qualify to pay the levy will need to consider the impact it may have on their businesses, including:

The government announced any unused levy funds (that is, those that have gone beyond the 24-month expiry date) will be used to fund apprenticeship training for small and medium-sized businesses that do not reach the threshold to pay the levy in the first place. It is expected the levy will raise approximately £2.5 billion per year for training in England and will cover all employers who take on apprentices, regardless of size or business sector, as there will be many employers who do not use all the money in their digital accounts.

This means non-qualifying businesses will not miss out and so, in other words, their not paying into the process doesn’t bar them from seeking funds to pay for training.

Non-levy paying businesses with more than 50 employees, or businesses that have used up their levy pot, will have to make a contribution of 10% towards the cost of apprenticeships. The remaining 90% will be paid for by the government. Smaller businesses will not have to make a contribution for apprentices up to the age of 23.

For all employers that take on apprentices between the ages of 16 and 18, they will receive a £1,000 government bonus payment. However, it is also worth noting the levy can be used to fund apprenticeships for new or existing employees of any age or position, as long as a genuine need for training exists.

Employed adults can undertake apprenticeship training – they do not need to be in entry level job roles and they can continue to be employed on their existing terms and conditions.

In light of these changes, it is important businesses consider their strategy for dealing with the new levy. Although it may focus primarily on lower-level staff, it should also reach up to include leadership and management programmes – and, in some cases, might also include professional training.